Banks | Increase quality, reduce time

We help banks understand companies and markets instantly, so every department can act with clarity and speed.

Syrto for

Banks

Italian companies available with complete data

Efficiency increase in identifying and prioritizing the right prospects

Faster process from company review to informed decision

We help business development teams quickly understand which companies to target, and why.

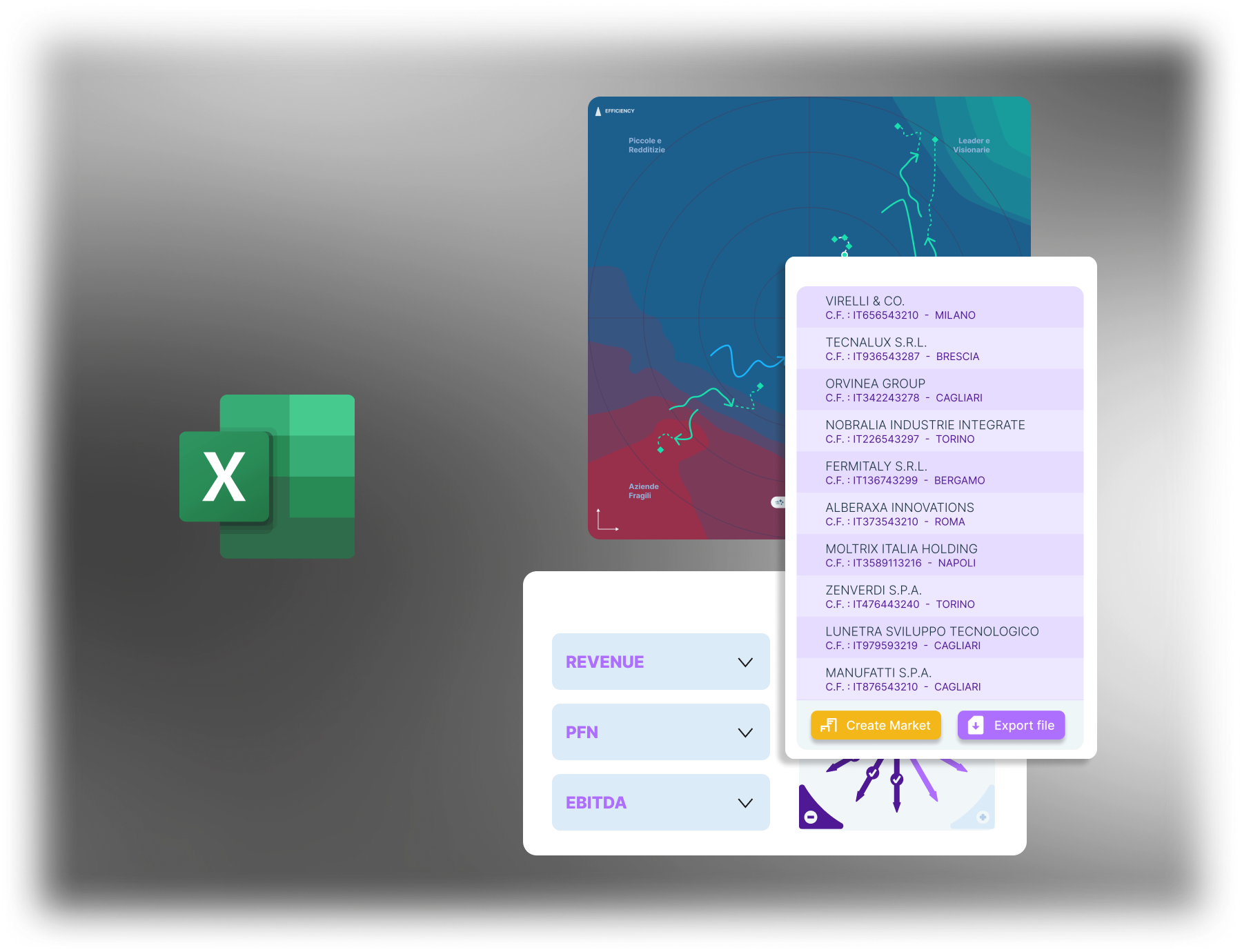

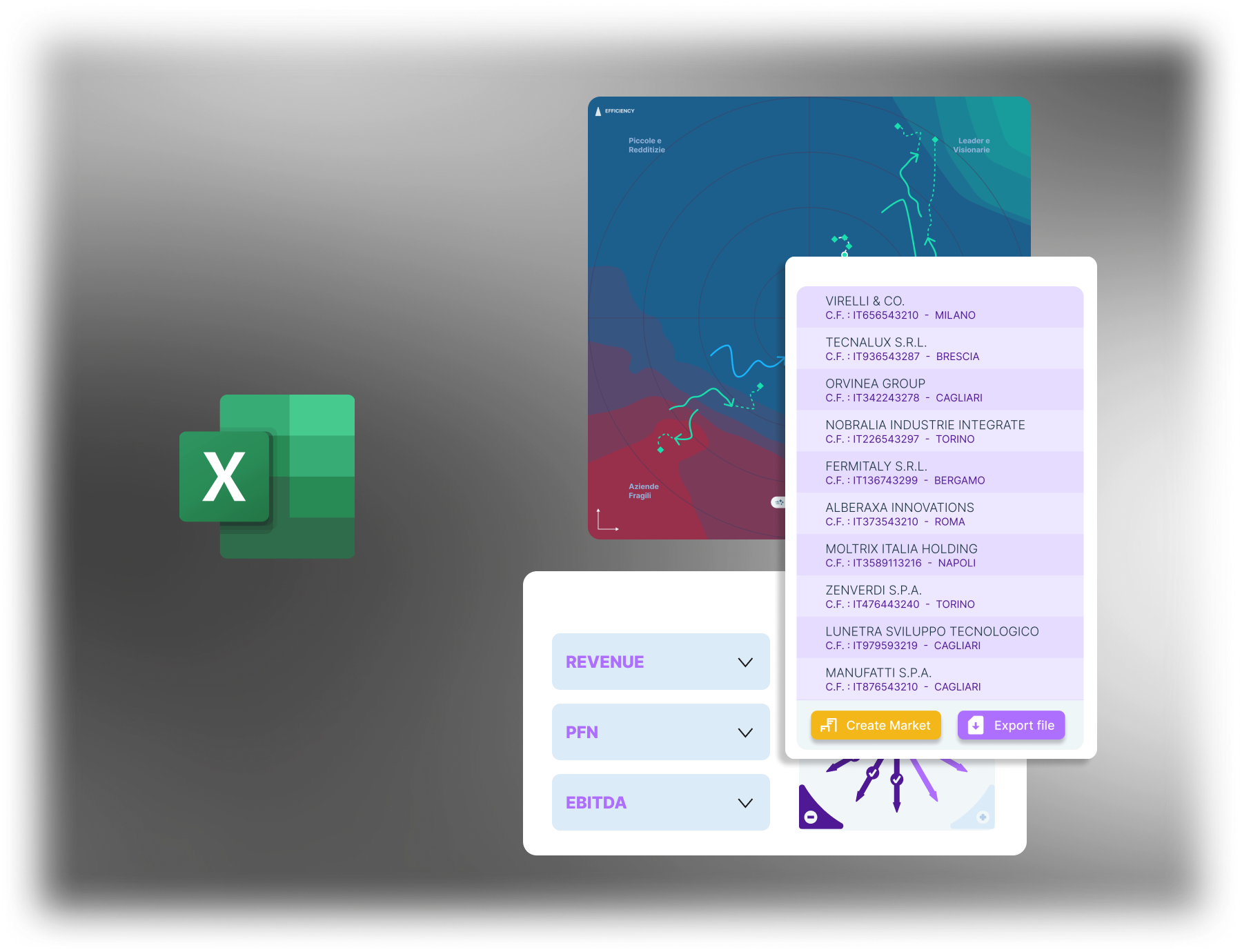

Manage and enrich development lists

Create or import prospect lists and instantly assess their quality.

Cluster companies by territory and sector to focus efforts where impact is highest.

Identify companies in target for your services

Define the ideal client profile and surface companies that match financial, size, and structural criteria.

Prioritize the right prospects

Narrow large universes down to the companies that deserve attention first.

Understand them instantly

Understand historical and financial health and assess market positioning by comparing peers, trends, and future scenarios.

Act effectively

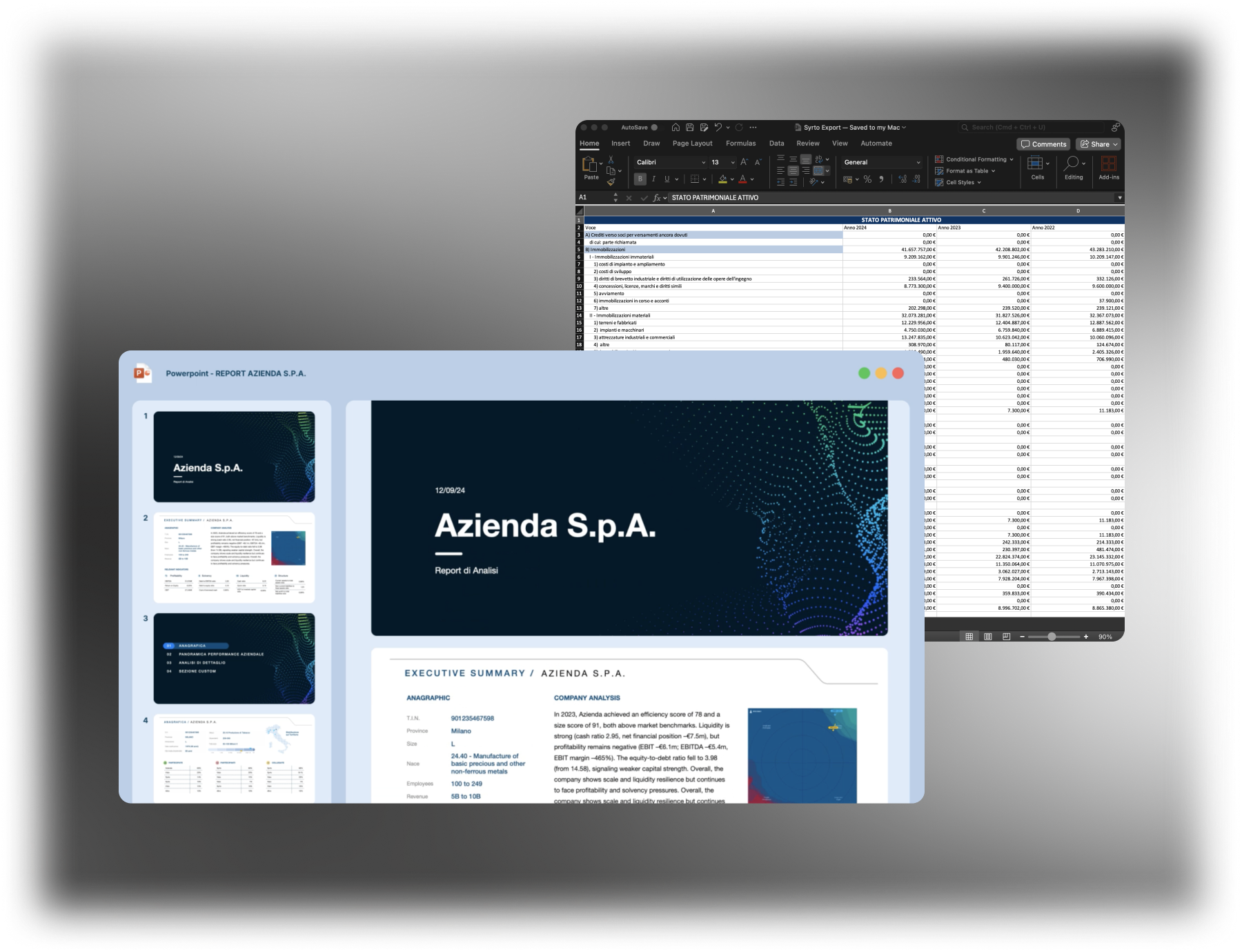

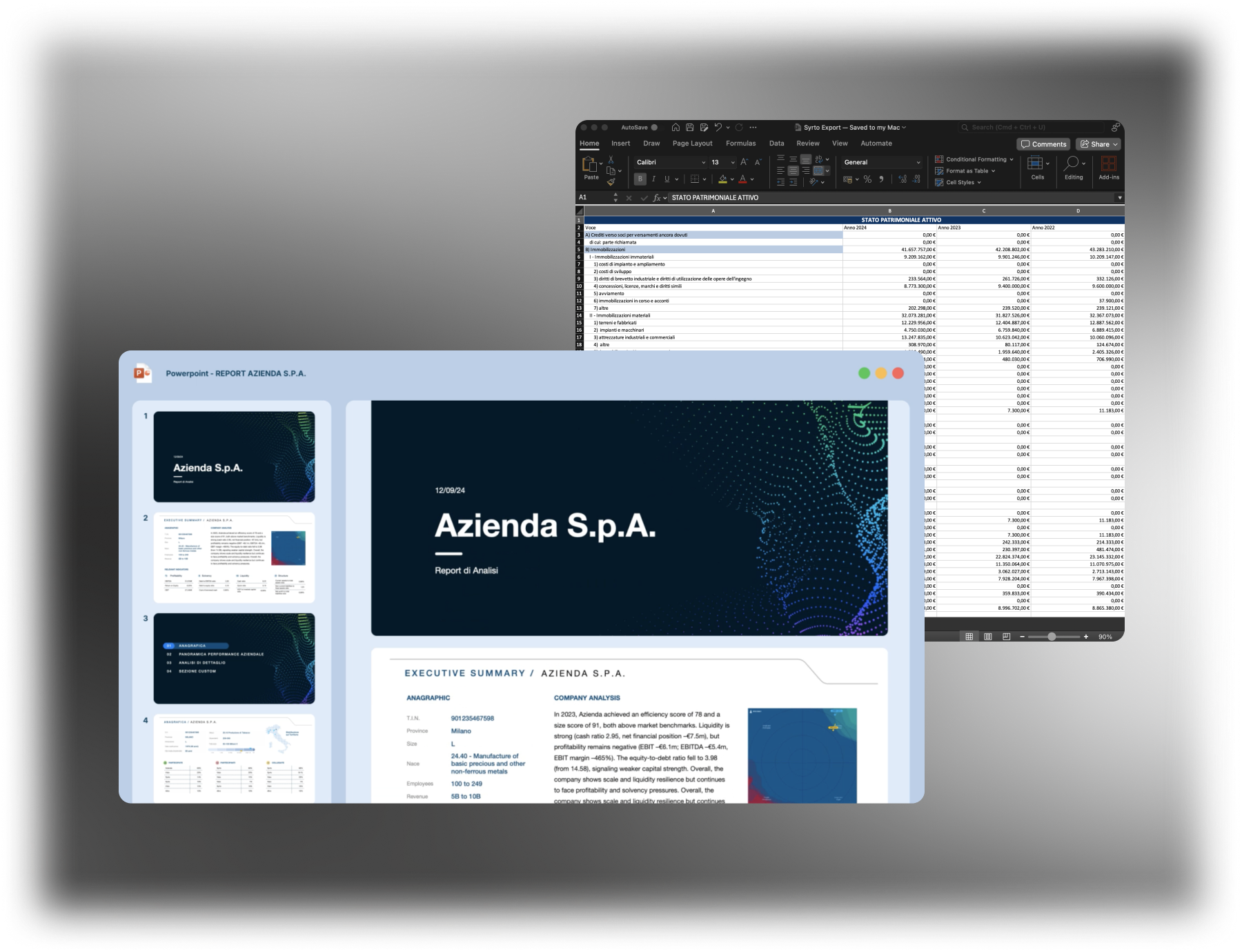

Use insights and reports to approach the best prospects with relevance, context, and credibility.

We help credit teams move from fragmented financial data to clear, risk-aware credit decisions, with speed and confidence.

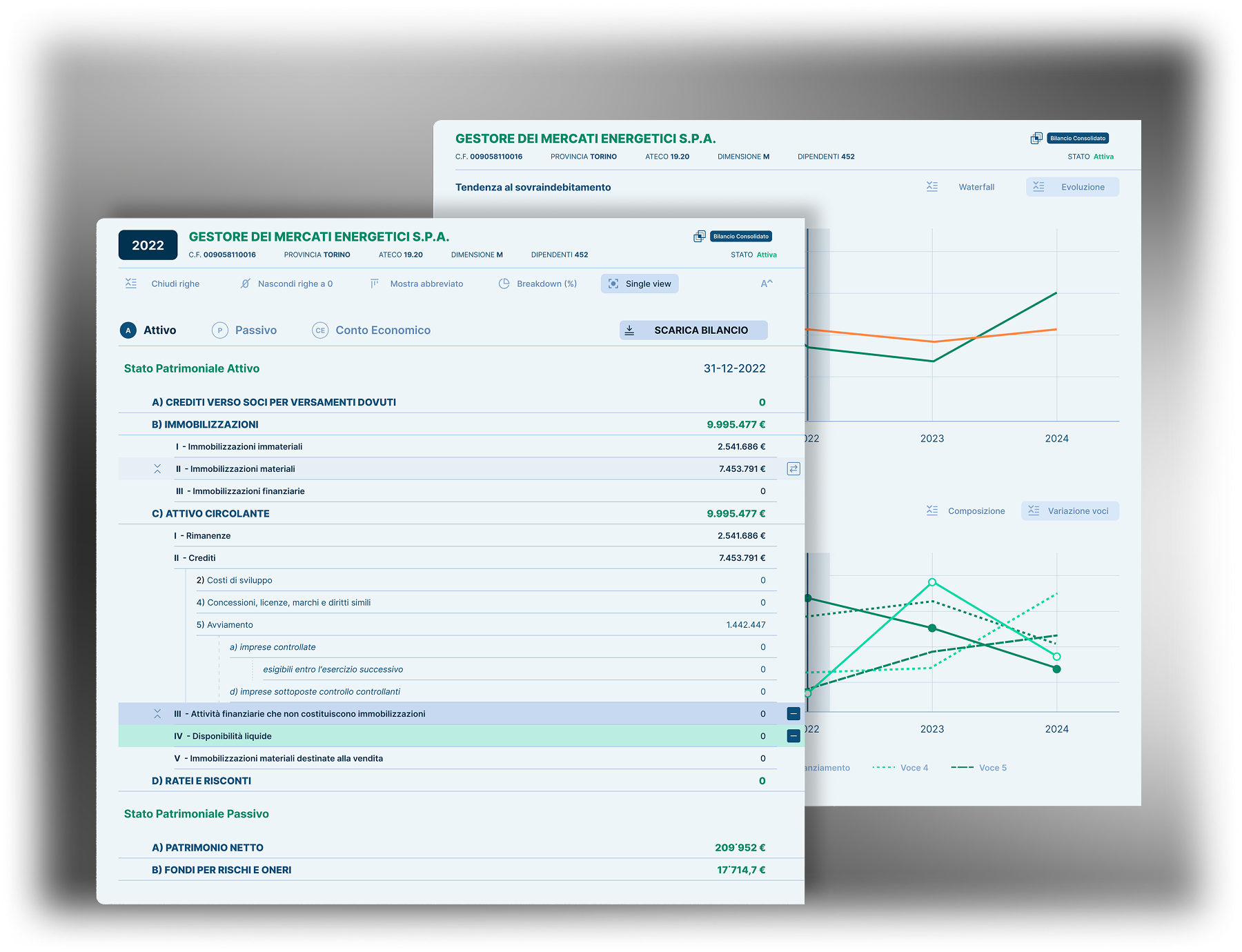

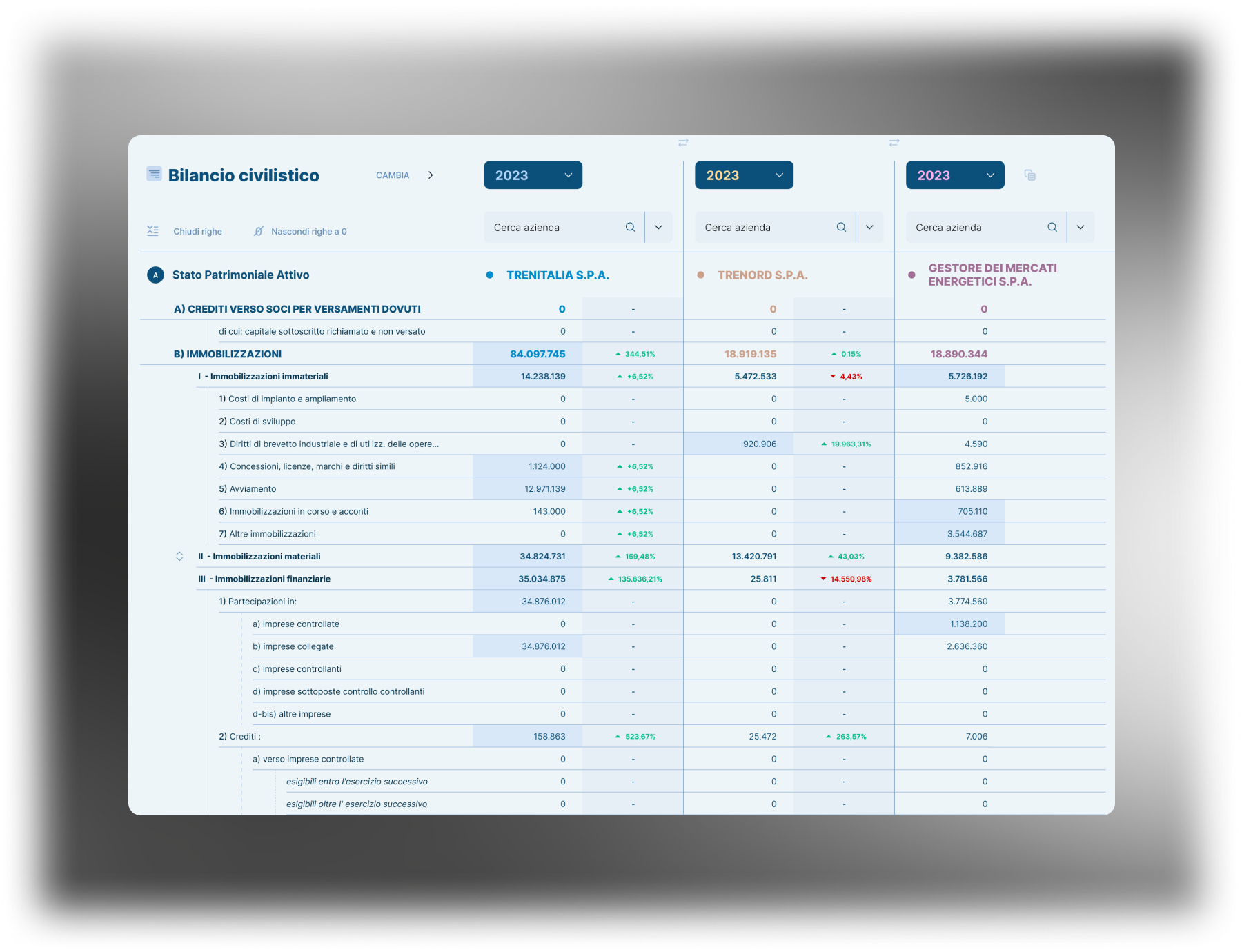

Get the full picture

Access complete historical and forward-looking financials for the company under review.

Move beyond one-year snapshots to a multi-year, structured view.

Understand the business context

Place the company within its market, peers, and competitive environment.

Understand how strategy, positioning, and sector dynamics affect risk.

Assess risk drivers

Analyze liquidity, cash flow, debt structure, and financial sustainability.

Identify strengths, weaknesses, and early warning signals. Go as deep as you need.

Compare and validate

Benchmark the company against peers and similar risk profiles.

Validate assumptions and reduce blind spots through comparison.

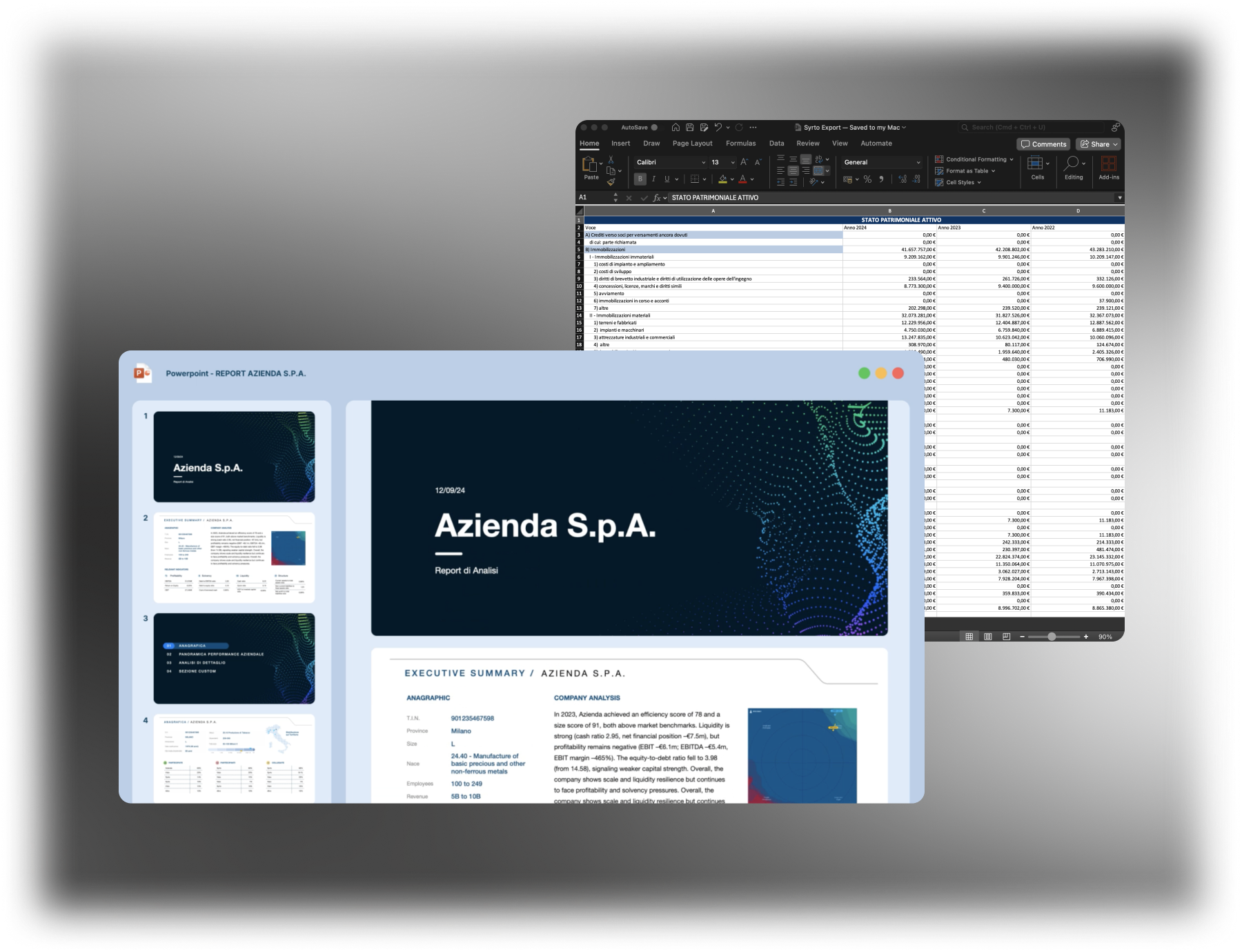

Support the granting process

Provide clear, explainable insights to support approval, pricing, or rejection.

Speed up decision-making without sacrificing depth or control.

We help risk teams detect weaknesses early and manage portfolio risk with clarity and control.

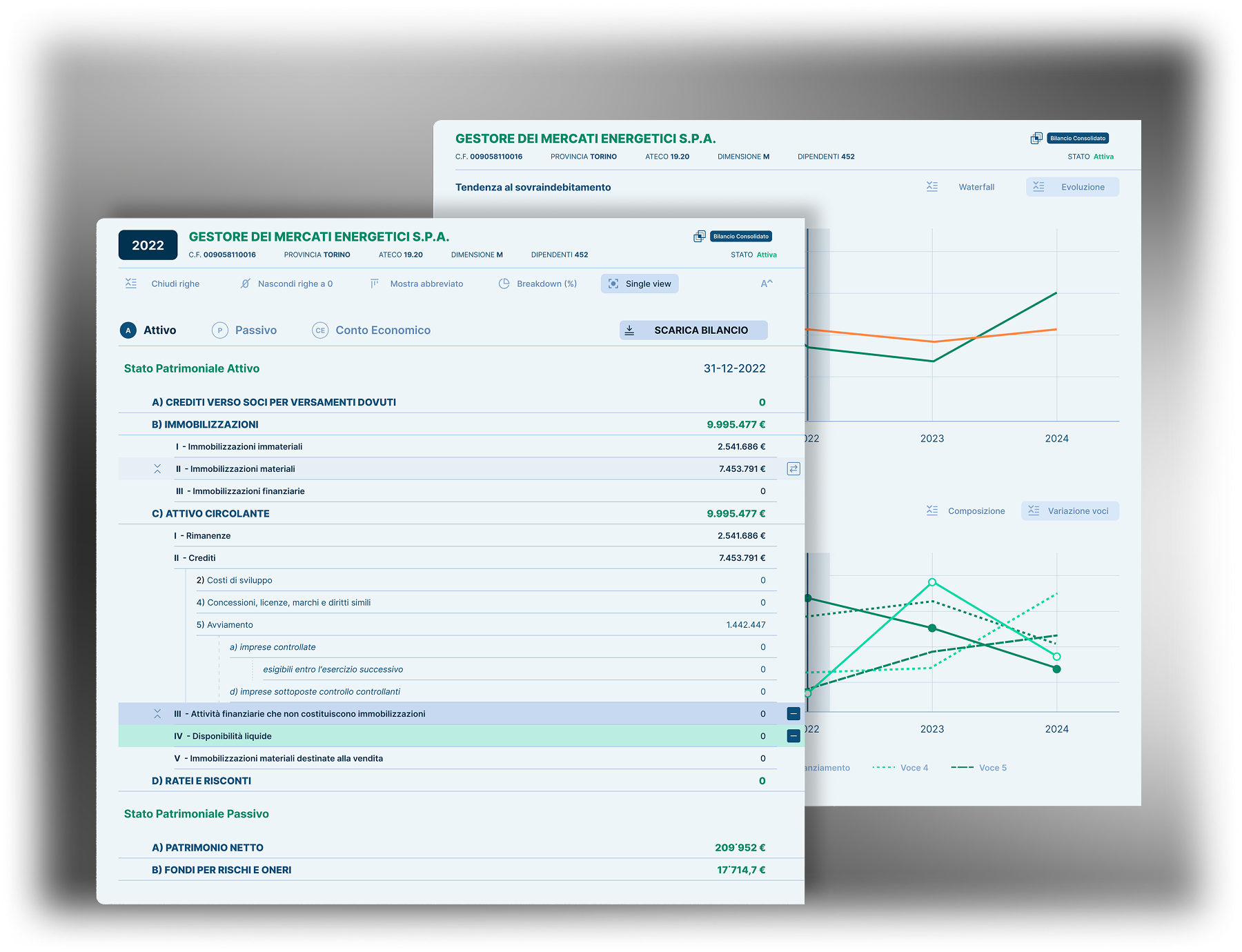

See the full portfolio

Import and visualize large portfolios of client companies in one shared view.

Get immediate visibility across sectors, geographies, and exposure clusters.

Segment risk and opportunity

Apply dynamic filters to segment companies by financial strength, behavior, and evolution.

Identify high-risk and high-potential clusters quickly.

Detect early warning signals

Spot weak signals of distress—liquidity pressure, debt stress, performance deterioration—before escalation.

Move from reactive to proactive risk management.

Analyze critical cases

Drill down into individual companies when alerts emerge.

Understand drivers, context, and trajectory with historical and forward-looking data.

Act in time

Support timely mitigation actions: closer monitoring, engagement, restructuring, or exposure adjustment.

Reduce portfolio risk while preserving value.